Crystal Wealth Newsroom

Mid-year review: why a balanced view is needed to understand what the future may hold

Generally, if markets expect a weakening economy, then bond prices can rise due to the expectation of interest-rate cuts.

Conversely, if the economy looks stronger, equities benefit while bonds often decline in value. This time, both asset classes declined in the first half of the year from higher inflation and higher rates, but also from a belief that the economic situation would worsen.

The second half of the year looks set to debate whether the US economy, in particular, is headed for a recession or is sufficiently robust to avoid one, as interest rates continue to normalise.

While July provided a reprieve for markets, with core indices reversing course and posting decent positive returns for the month, the path ahead clearly remains clouded.

It is certainly encouraging that the US is not yet in recession, given recent solid services data and the underlying strength of the labour market. However, this means the idea that the US Federal Reserve may ‘pivot’ soon away from its current tightening policy is less convincing while the jobs market (and hence the potential for wages growth) remains strong.

While the outlook for Europe and the UK is bleaker, and European inflation may be tougher to cure, the focus remains on the US, given its central role as the lead economy and potentially offset a currently weaker Chinese economy.

Although falling commodity prices will help push down headline inflation in the coming months, core inflation will likely fall more slowly due to strong underlying wages and housing rents.

This means further rate rises are still firmly on the cards, even as there may be some easing in longer-term inflation expectations. In other words, markets continue to assess how much more central banks will need to raise interest rates now and/or whether they could be forced then to cut them in 2023.

RBA tone has changed as cash rate reaches a six-year high

Domestically, this year, the Reserve Bank has lifted interest rates four months in a row, pushing the cash rate up by 0.50% to 1.85%, representing a six-year high.

However, the tone of the RBA statement now differs from earlier releases, suggesting that perhaps moving forward, smaller rate increases would follow compared to initial larger increases.

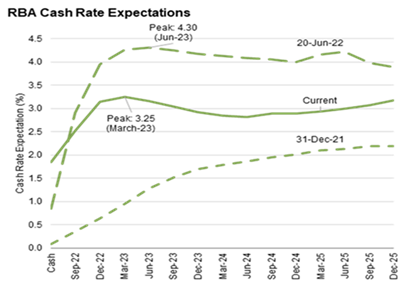

This will depend on future data points, but presently forward views on the cash rate appear to be coming down as global supply pressures on inflation also appear to be easing. After all, markets have a habit of overshooting – both up and down on a regular basis.

As of 2 August 2022. Source: PIMCO/Bloomberg.

At this time, we think it is prudent to consider some balance in the current dialogue around the forward-looking outlook for the rest of the year.

Specifically, it is important to be aware of the tendency for negative biases to be reinforced without necessarily considering all positions. For example, assuming trends will continue as they are now – e.g. inflation continues to increase.

There are several key assertions regularly espoused in the current messaging around high inflation, high interest rates and recession outcomes that are worth considering further:

- Global shipping supply chains

Covid was an event-based disruption rather than a permanent supply change. This means shipping capacity and efficiency are rapidly improving, and prices falling, such that blockages are beginning to ease, which would be a positive for the supply of goods. In fact, there is evidence of overstocking with some retailers. - Reshoring supply chains

The US is already building large chip manufacturing plants in Texas and Arizona, and many of the goods being reshored are higher value/complex goods (e.g. technology intensive). This move can help western economies increase resilience to future geo-political disruptions while providing impetus for local economies due to the development work required to support industry change.

- Ever increasing rates

The level of future interest rates is set in the bond market based on future market expectations and current cash rates. Despite higher short-term readings, 5-10 year forward inflation expectations are lower due to concern about slowing GDP growth. Putting downward pressure on future inflation expectations is not bad for growth assets longer-term.

Given corporate balance sheets are in far better shape than in previous ‘recessionary’ times, a key focus now is on the activity and behaviour of consumers and overall sentiment.

In the US, the current debt servicing cost as a percentage of household disposable income is lower than previous ‘crisis’ levels and domestically, consumer balance sheets are in good shape to withstand at least the initial rate rises.

Consumer confidence is being tested with concerns over higher energy costs and increased mortgage rates, and thus declines in property prices. While a recession cannot be ruled out, it is far from clear that any such ‘technical’ recession will endure the depth and duration of previous ones unless unemployment increases significantly.

However, there is an upside here.

Lower equity prices and higher interest rates mean returns going ahead are likely to be a good deal higher than our expectations six months ago.

In fact, following these price corrections, the outlook for both growth and defensive assets is now more attractive. This is despite the short-term uncertainties. In fact, it is because of the uncertainties that these more attractive returns are on offer.

It doesn’t mean asset values can’t fall further from here, it is just that because of the repricing within markets’ more defensive assets, such as bonds, are also starting to offer value again to help balance portfolio outcomes.

The rising cyclical risks suggest that assets offering a decent yield, with an inflation link to revenues and/or earnings, remain in focus where growth can be delivered within an uncertain environment.

Earnings delivery remains an important driver of returns and particularly within a higher inflation environment. While we may be nearing (or at) peak inflation readings globally as some of the previous inflationary drivers abate, there are still upside risks to inflation and monetary policy that must be watched and managed carefully within portfolios.

On balance, across multi-asset portfolios, we believe it makes sense to remain invested with a well-diversified mix of asset sectors and exposure to alternatives.

The ability to earn 5%+ p.a. from quality fixed income assets now provides an important backstop to growth assets and managing future cash flows despite the elevated uncertainty that looks set to continue.