Crystal Wealth Newsroom

ESG Investing Factors: The impact of responsible investments

ESG Investing refers to investments that identify the significance and measure the impact of environment, social and governance (ESG) matters.

Regulators, companies, fund managers and investors are being encouraged to recognise the relevance of incorporating ESG factors to enhance corporate transparency and performance, and the measurement of risk. The availability of increasing amounts of ESG data is allowing investors to incorporate these strategies into portfolio construction, also known as ESG Investing.

By focusing on ESG factors and data we can identify companies that are leading or lagging in their industry or sector and pinpoint significant risks relevant to the company or industry.

| ESG Factor | Positive Impact | Negative Impact |

| Environment factors | Positive outcomes might include avoiding or minimising environmental liabilities, lowering costs and increasing profitability through achieving energy and other efficiencies, reducing regulatory, legislation or reputational risk. | Negative impact would include polluting or degrading the environment, adding to atmospheric carbon levels, threatening a region’s biodiversity or cultural heritage or risks associated with climate change, reduced air quality and/ or water scarcity. |

| Social factors | Social positive outcomes could include increasing employee productivity and morale, reducing staff turnover and absenteeism and improving brand loyalty. | Negative issues might include sub-standard conditions for production employees in third world countries, aiding human conflict, facilitating crime or corruption, poor product integrity, inadequate health and safety policies for employees customers or suppliers, harming the local community, or risks associated with large-scale pandemics or shortages of food, water or shelter. |

| Governance factors | Positive outcomes would include aligning the mutual interests of shareholders and management, improving timely disclosures, and the avoidance of unpleasant surprises | Negative connotations such as the way companies are run, lack of board independence and diversity, weak corporate risk management, poor corporate culture, excessive executive remuneration, and inadequate product/ market diversification. |

There is no definitive list of ESG issues that an investor could consider when making investment decisions and each factor has differing implications that can materially influence a company’s investment performance.

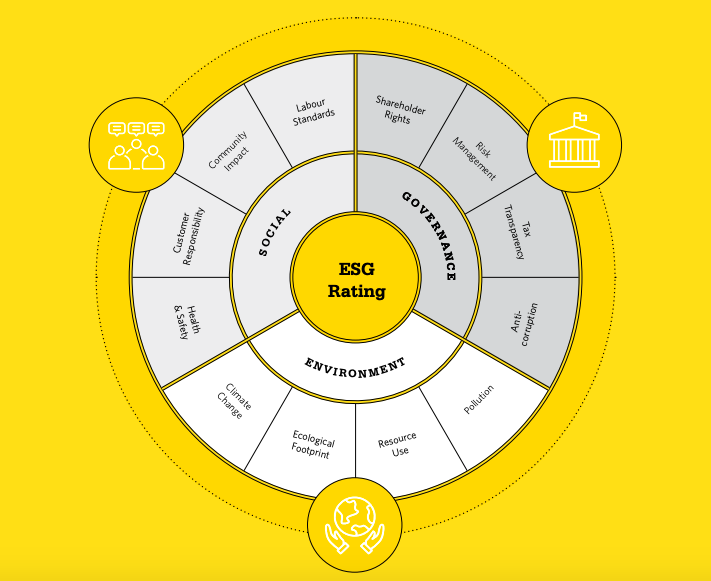

The diagram below illustrates some of the commonly used ESG considerations:

If you are interested in setting up a portfolio that considers ESG factors, contact one of our advisors now on the ‘contact us’ page.